Free 3-part video course

Plan B

Protect your assets from expropriation!

Think carefully about the following facts and then ask yourself the following question: 1.2% of the world's population own 47.8% of the world's wealth. In the last 40 years, over 50 trillion US dollars have been redistributed from the middle class to the financial elite.

There are too many politicians in power around the world who represent the interests of corporations and the super-rich. Why should this process come to a halt?

We are currently in the phase in which the final gear for redistribution and expropriation has been engaged.

The redistribution of wealth is to be completed by the end of 2030: Agenda 2030 or Great Reset. The name doesn't matter, but the result is relevant: Many people will be impoverished and few people will be happy. That is neoliberalism.

With this free training course, the Social Business Investors Club wants to give you a plan to protect your assets from expropriation. By registering, you automatically become a free member of a people-oriented community.

The training is available as a video and in PDF format.

We will support you with your Plan B.

Omid Manavi

CEO Manavi Sales

The development can be stopped

- With the democratization of capital, this negative development can be brought to a halt, at least in part. Politicians must be obliged by law to be neutral. The sooner, the better!

- The Social Business Investors Club is committed to a people-oriented economy and financial system. Let's be HeartRock! Over the next ten years, together we want to finance 1 million people-oriented jobs.

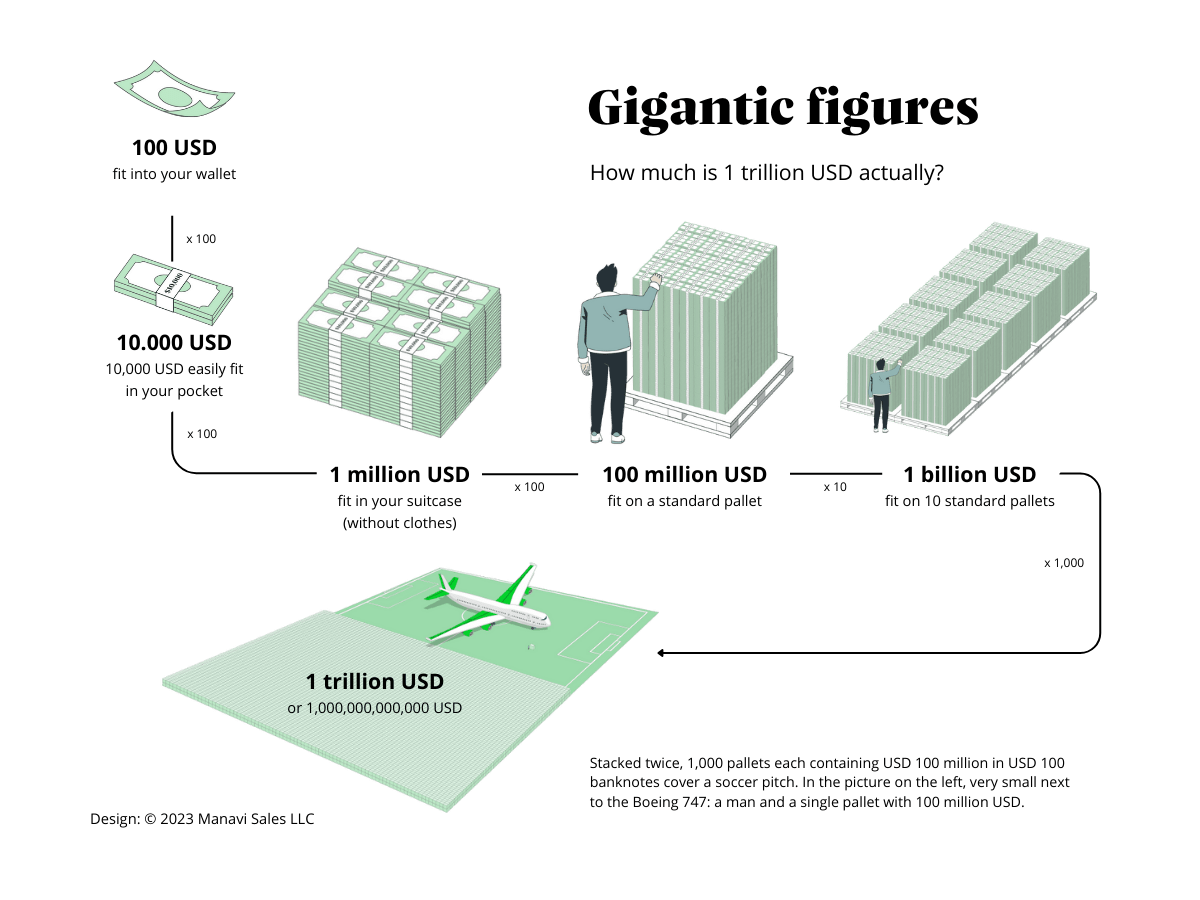

How much is 1 trillion USD?

Very few people can imagine millions, billions, trillions or even quadrillions. To illustrate this, we would like to explain.

1 million = 1,000,000

1 billion = 1,000,000,000 (1,000 million; 1 billion)

1 trillion: 1,000,000,000,000 (1,000 billion; 1 trillion)

1 quadrillion: 1,000,000,000,000,000 (1,000 trillion)

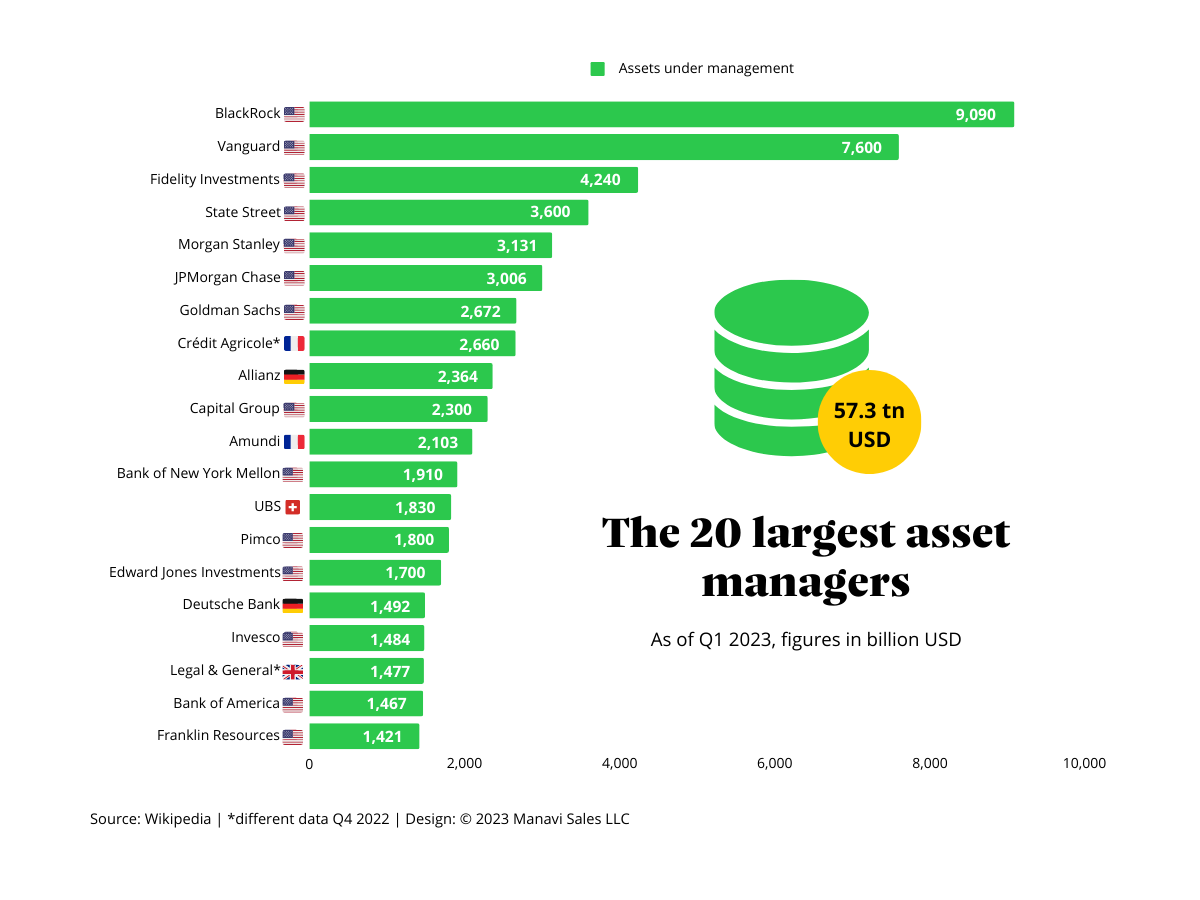

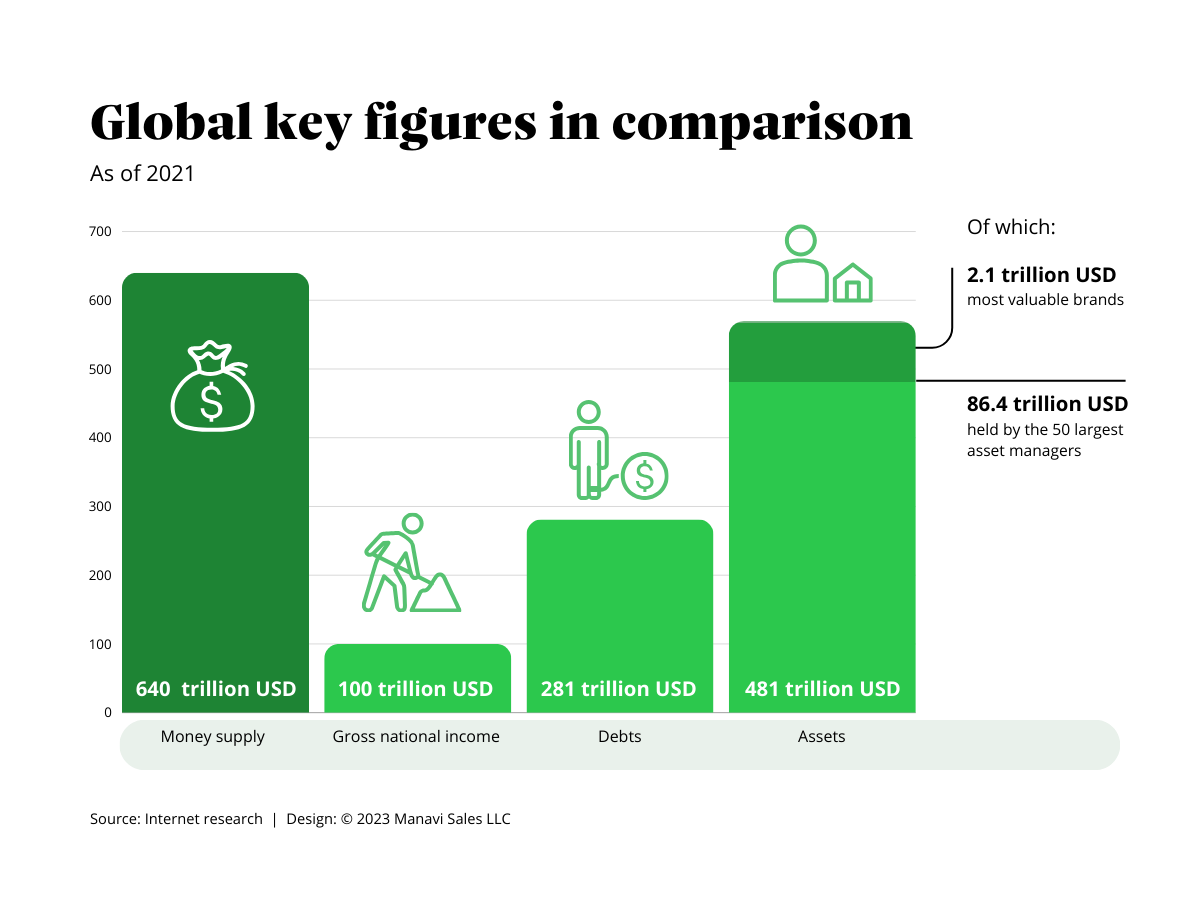

The 50 largest asset managers hold 20% of the world's assets

The 50 largest asset managers in the world manage over USD 86,412 billion in assets. This corresponds to 20 % of global assets. Investment banks are now the shadow rulers of nation states through their financial power.

Is that really what we want?

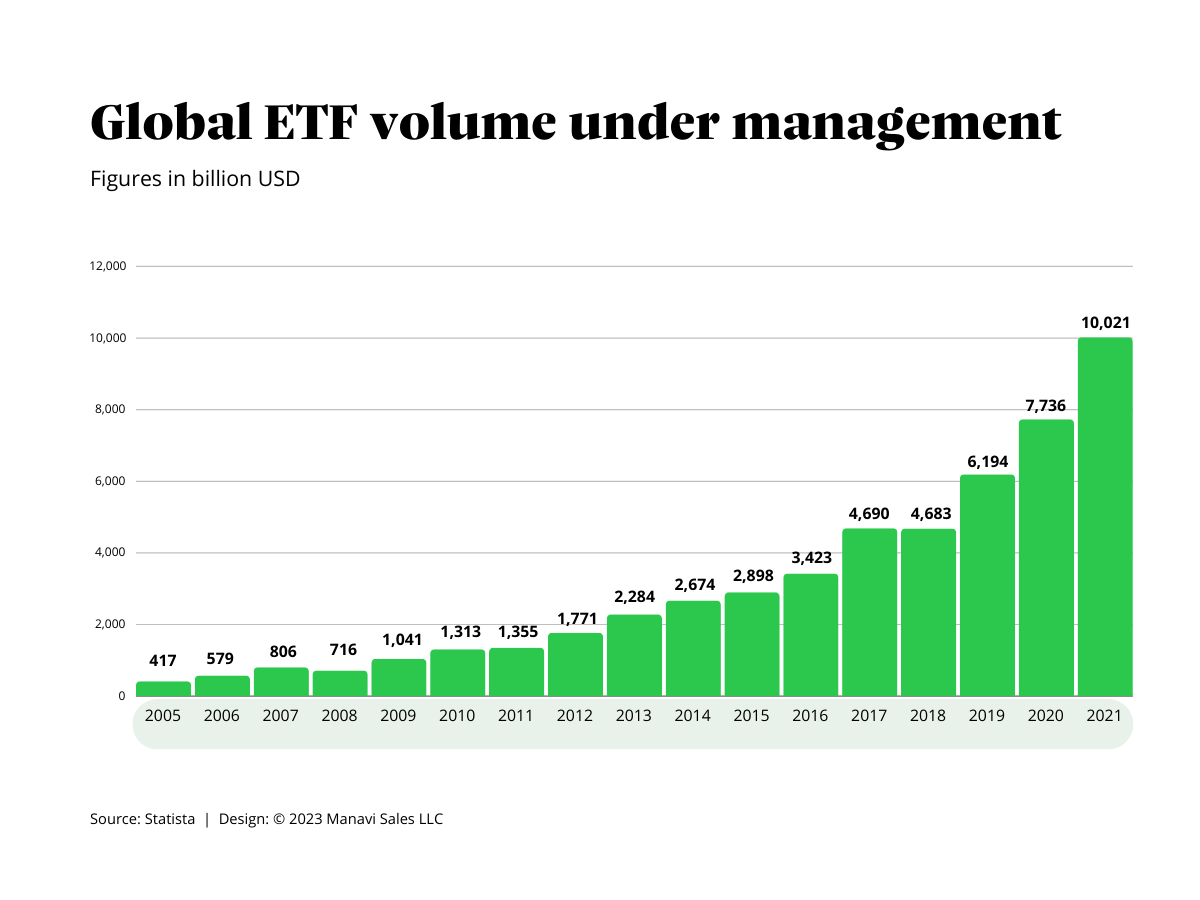

ETFs lead to a monopolization of the markets

Three investment banks dominate 75% of the ETF market (BlackRock, Vanguard, State Street), which significantly increases the manipulation of the financial markets.

Since 2005, the exchange-traded ETF market has grown from USD 417 billion to more than USD 10,021 billion.

ETFs are a cost-effective way for small investors to participate in the stock markets. However, the concentration of capital in three asset managers means that ETFs are monopolizing the markets.

What happens when the bubble bursts?

The 19 largest corporations in the world have a combined market value of more than USD 2 trillion. This compares with an estimated annual turnover of around USD 2.4 trillion and profits of USD 420 billion. The average price/earnings ratio (P/E ratio) of these 19 companies is 24.

Warren Buffet, one of the world's most successful value investors, generally buys at a P/E ratio of 10, which means that the shares of these companies are overvalued. What happens when the share bubble bursts?

These high valuations are the result of market manipulation.

Do we really want that?

On average, every person has USD 40,000 in debt

The global money supply amounts to USD 650 trillion to around USD 1.2 quadrillion. Nobody knows exactly. This is six to twelve times greater than the global gross national income (GNI) of around USD 100 trillion (2022).

Total global debt in 2021 amounted to over USD 281 trillion. That is three times as much as the global gross national product. The average person in the world had debts of almost 40,000 US dollars. Most sensible economists are concerned about global debt.

The global stock of government bonds amounted to USD 91 trillion (2016), accounting for almost 90% of gross national income. This level of debt inevitably leads to insolvency for a company. This means that many countries are on the brink of financial bankruptcy.

The world's largest asset managers (shadow banks) are stepping in to save the nation states. These nation states are partially privatized in order to get out of the debt trap. The monopolization of markets and the privatization of nation states for the capitalist dictatorship of corporations and NGOs, as is becoming increasingly clear.

Is that really what we want?

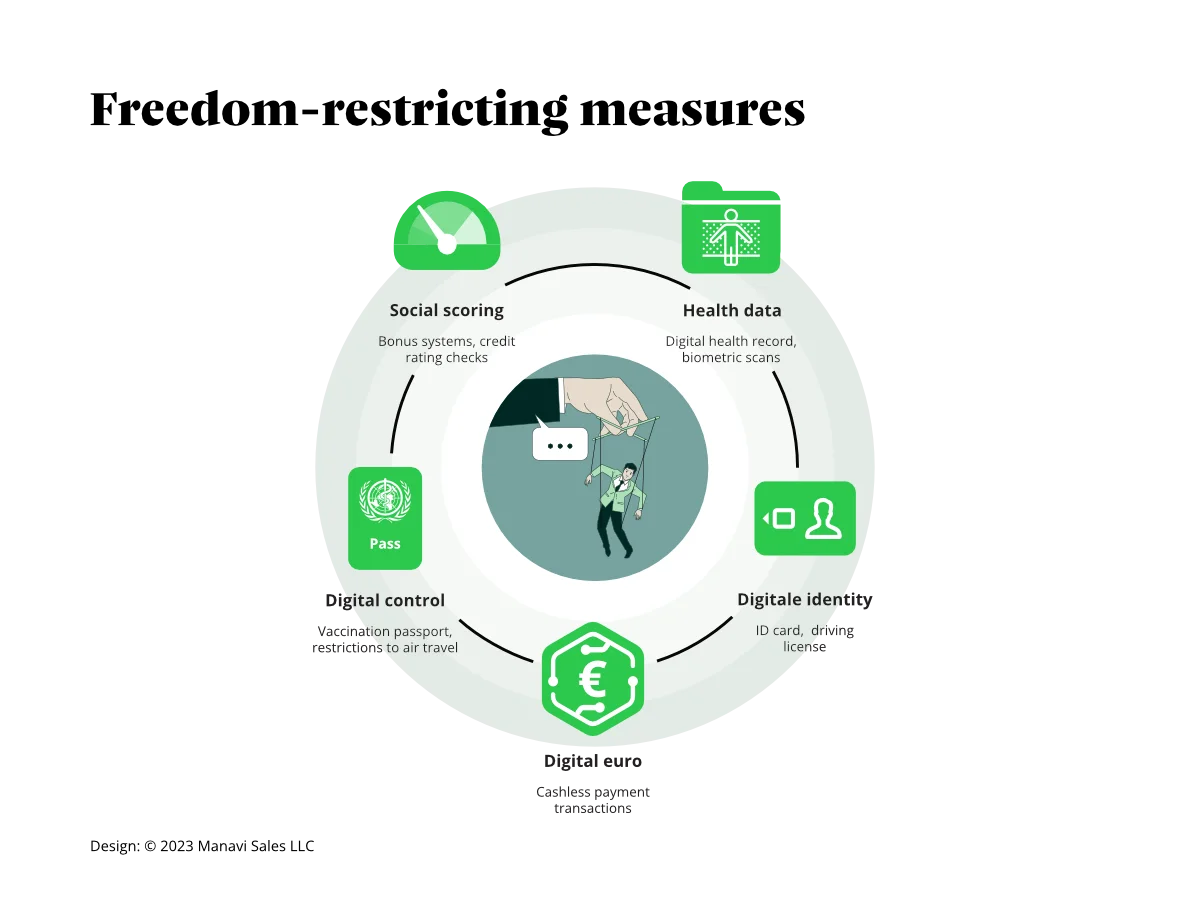

The citizens become transparent and controllable

The introduction of Central Bank Digital Currency (CBDC) will lead to the monitoring of most financial transactions. In combination with social scoring systems and digital ID cards, citizens will become transparent and controllable.

One example is the CO₂ account introduced by eBay. In addition to information about the CO₂ emissions of individual purchases, "My CO₂ account" also displays information about the CO₂ emissions of all purchases made via the online marketplace.

If all accounts are digitally networked, this means, for example, that the credit card is blocked when the current CO₂ balance has been used up.

If nation states are partially privatized by the shadow banks, this means that the corporations are actually monitoring the citizens of a state: "Follow the Money".

Citizens are incapacitated and degraded to consumers of the corporations.

Is that really what we want?

The Solution: A decentralized financial system

- 1Politicians must not receive additional income from corporations and NGOs

- 2The regional and local economy must be strengthened

- 3A decentralized democratic financial system must be established

- 4The monopolization of the markets must be stopped as soon as possible.

- 5Politicians must immediately be committed to their people again.

- 6The privatization of nation states must be stopped immediately.

- 7The social market economy must be restored.

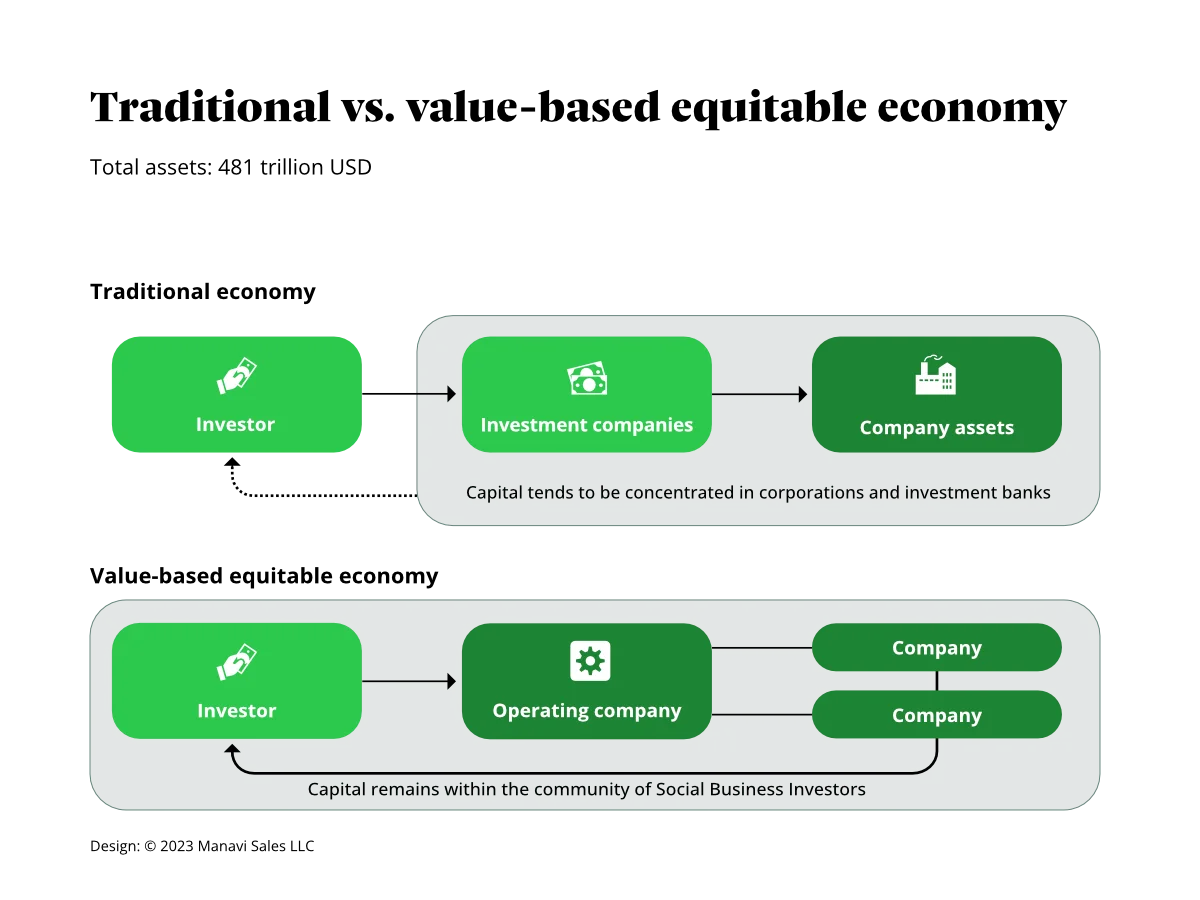

Global wealth amounts to USD 481 trillion

Over the last forty years, there has been a steady transfer of wealth of over USD 40 trillion from the ordinary population to the financial elite. This means that the wealth of ordinary citizens has shrunk by USD 50 trillion.

How much wealth could be created worldwide if this wealth were distributed more democratically?